Friday, September 01, 2006

THE ROTH IRA WAY

Dear Samuel,

I'm in the airport, and I have time for a more lengthy post, so here goes.

I don't know if you know cousin P. I'm sure you've met him before but I doubt his face comes to your mind. P has no college degree, there is a good chance he never will. He'll be stuck doing certain jobs his whole life that a lot of people wouldn't want to do. P is younger than me by a couple of years.

your mind. P has no college degree, there is a good chance he never will. He'll be stuck doing certain jobs his whole life that a lot of people wouldn't want to do. P is younger than me by a couple of years.

And guess what, P has more assets than I do, by a good margin. Do you know why? Because his parents basically forced him into fully funding a Roth IRA each year.

What is an IRA? - It stands for Individual Retirement Account. There are several kinds of retirement accounts. The biggest difference is between the traditional IRA (which people just refer to as an IRA), and the Roth IRA (which was more recently introduced in the nineties).

Why would anybody want to start an IRA? To answer that question I want you to imagine your life as if it were a movie and you can play with the movie as if you were watching it on video and you have the remote control to the VCR. You're watching the movie, you hit the rewind button and see your life for the last week or so. Now imagine you hit the fast forward button and watch yourself live in superfast motion as you blow through your teens, your twenties, your thirties, and keep on watching yourself until you're in your eighties. Now slow down the movie to play. You'll notice that you're walking slower, you've got some gray hair. If you look really closely you'll notice that you don't have a job, and you still have bills to pay.

Eventually all our human assets will become worthless, and we have to live off the reserve capital we've set aside along the way. That's why people save for retirement. That's where IRA's, and Roth IRA's come in. There is one simple difference between the traditional and Roth IRA's.

You put pre-tax money into a traditional IRA, and you put after-tax money into a Roth IRA. So let's say that you're a fifty year old plumber making $45,000 per year. If you put $2000 into an IRA then you would only have to pay taxes on the remaining $43,000 because the IRA donation would act as a tax deduction. If you had put that $2000 into a Roth IRA you would have to pay taxes on the whole $45,000.

There is one more difference. When you retire and start taking your money out of your traditional IRA you have to pay taxes on that money. Why? Because you didn't pay taxes on it before you put it into the IRA. So if you put your $2000 into and it grew at 8% per year for forty years it would be $43,000. With the traditional IRA you have to pay taxes on whatever money you take out of your IRA as if it were income.

When you retire and start taking money out of a Roth IRA you don't have to pay any taxes on that money. Why? Because you already paid taxes on that money. Remember you couldn't take a tax deduction. So forty years from now you get to spend all of those $43,000 without paying any income taxes on it.

That is what makes P's strategy so awesome. As long as you make less than like $10,000 per year you pay no income taxes at all. So if you have some job -say McDonalds - while you're in high school, and you make $10,000 over the course of the year you won't be paying taxes on it anyway. If you take $2000 of that $10,000 and put it into a Roth IRA, then leave it there for 40 years and it grows to $43,000, you just got away with making $41,000 and you don't ever have to pay taxes on that money! That is HUGE!!!

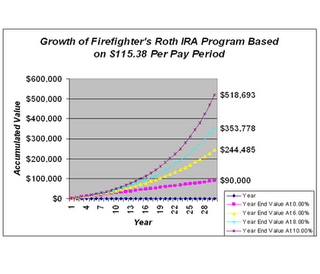

So let's consider a possible scenario together. When you're 16 years old you work a summer job at McDonalds. You sock away $2000 into a Roth IRA account. It would be easy. Minimum wage minus FICA would make $2000 in 10 weeks. That's flipping burgers for June, July, and half of August. You change jobs when you're 17 and work at Arby's the following summer and manage to sock away $2000 that year. That's slicing roast beef for June, July, and half of August. Do that until you're 22 years old and all you have to do is sit on your rear end until you're sixty five years old, and assuming you get an average return of 10% on that money you will have something like 1.25 million dollars tax free.

It's beyond the scope of this post, but suffice to say that it isn't particularly hard to have a passive income of $10,000 per month if you've got 1.25 million dollars to your name.

Cousin P is on his way. As young as you are, all you need to do is make a couple of smart decisions and you can seriously set yourself up to be in a good situation.

I had a job from starting as a 10 year old throwing newspapers. If I had saved half of my money and put it in an interest bearing account, then when Roth IRA's became available put my money into one.... (Jay shakes his head slowly)

But do you know what I did with that money? I used to finish my paper route and ride my bike over to the grocery store and buy an ice cream cone. Then I rode over to the gas station and threw quarters down a video game machine playing 'Teenage Mutant Ninja Turtles' so I could put my name in 1st place. They re-set it every day so I always wanted to go back to show the world who was the bomb diggity at TMNT.

What was I thinking? I was thinking the same thing every 10 or 11 year old kid would have been thinking. "Hey, I could really use an ice cream cone right now." "Better head over and show who's boss at the video arcade."

Lame!

The race does not always go to the swift. Don't do it like I did it. That was stupid. Set yourself up for success.

Later,

Jay

I'm in the airport, and I have time for a more lengthy post, so here goes.

I don't know if you know cousin P. I'm sure you've met him before but I doubt his face comes to

your mind. P has no college degree, there is a good chance he never will. He'll be stuck doing certain jobs his whole life that a lot of people wouldn't want to do. P is younger than me by a couple of years.

your mind. P has no college degree, there is a good chance he never will. He'll be stuck doing certain jobs his whole life that a lot of people wouldn't want to do. P is younger than me by a couple of years.And guess what, P has more assets than I do, by a good margin. Do you know why? Because his parents basically forced him into fully funding a Roth IRA each year.

What is an IRA? - It stands for Individual Retirement Account. There are several kinds of retirement accounts. The biggest difference is between the traditional IRA (which people just refer to as an IRA), and the Roth IRA (which was more recently introduced in the nineties).

Why would anybody want to start an IRA? To answer that question I want you to imagine your life as if it were a movie and you can play with the movie as if you were watching it on video and you have the remote control to the VCR. You're watching the movie, you hit the rewind button and see your life for the last week or so. Now imagine you hit the fast forward button and watch yourself live in superfast motion as you blow through your teens, your twenties, your thirties, and keep on watching yourself until you're in your eighties. Now slow down the movie to play. You'll notice that you're walking slower, you've got some gray hair. If you look really closely you'll notice that you don't have a job, and you still have bills to pay.

Eventually all our human assets will become worthless, and we have to live off the reserve capital we've set aside along the way. That's why people save for retirement. That's where IRA's, and Roth IRA's come in. There is one simple difference between the traditional and Roth IRA's.

You put pre-tax money into a traditional IRA, and you put after-tax money into a Roth IRA. So let's say that you're a fifty year old plumber making $45,000 per year. If you put $2000 into an IRA then you would only have to pay taxes on the remaining $43,000 because the IRA donation would act as a tax deduction. If you had put that $2000 into a Roth IRA you would have to pay taxes on the whole $45,000.

There is one more difference. When you retire and start taking your money out of your traditional IRA you have to pay taxes on that money. Why? Because you didn't pay taxes on it before you put it into the IRA. So if you put your $2000 into and it grew at 8% per year for forty years it would be $43,000. With the traditional IRA you have to pay taxes on whatever money you take out of your IRA as if it were income.

When you retire and start taking money out of a Roth IRA you don't have to pay any taxes on that money. Why? Because you already paid taxes on that money. Remember you couldn't take a tax deduction. So forty years from now you get to spend all of those $43,000 without paying any income taxes on it.

That is what makes P's strategy so awesome. As long as you make less than like $10,000 per year you pay no income taxes at all. So if you have some job -say McDonalds - while you're in high school, and you make $10,000 over the course of the year you won't be paying taxes on it anyway. If you take $2000 of that $10,000 and put it into a Roth IRA, then leave it there for 40 years and it grows to $43,000, you just got away with making $41,000 and you don't ever have to pay taxes on that money! That is HUGE!!!

So let's consider a possible scenario together. When you're 16 years old you work a summer job at McDonalds. You sock away $2000 into a Roth IRA account. It would be easy. Minimum wage minus FICA would make $2000 in 10 weeks. That's flipping burgers for June, July, and half of August. You change jobs when you're 17 and work at Arby's the following summer and manage to sock away $2000 that year. That's slicing roast beef for June, July, and half of August. Do that until you're 22 years old and all you have to do is sit on your rear end until you're sixty five years old, and assuming you get an average return of 10% on that money you will have something like 1.25 million dollars tax free.

It's beyond the scope of this post, but suffice to say that it isn't particularly hard to have a passive income of $10,000 per month if you've got 1.25 million dollars to your name.

Cousin P is on his way. As young as you are, all you need to do is make a couple of smart decisions and you can seriously set yourself up to be in a good situation.

I had a job from starting as a 10 year old throwing newspapers. If I had saved half of my money and put it in an interest bearing account, then when Roth IRA's became available put my money into one.... (Jay shakes his head slowly)

But do you know what I did with that money? I used to finish my paper route and ride my bike over to the grocery store and buy an ice cream cone. Then I rode over to the gas station and threw quarters down a video game machine playing 'Teenage Mutant Ninja Turtles' so I could put my name in 1st place. They re-set it every day so I always wanted to go back to show the world who was the bomb diggity at TMNT.

What was I thinking? I was thinking the same thing every 10 or 11 year old kid would have been thinking. "Hey, I could really use an ice cream cone right now." "Better head over and show who's boss at the video arcade."

Lame!

The race does not always go to the swift. Don't do it like I did it. That was stupid. Set yourself up for success.

Later,

Jay